Wondering, “Does homeowners insurance cover garage doors?” You’re not alone. Before you file a claim, ensure you understand your policy’s specifics and avoid costly mistakes.

Homeowners’ insurance protects your most significant investment: your home. However, many homeowners are unclear about their policies, especially regarding structures like garage doors. If you’re standing in front of a damaged garage door, asking, “Does homeowners insurance cover garage doors?” you need a straight answer backed by facts.

Garage doors are more than just an entry point for your vehicle. They’re a significant component of your home’s security, curb appeal, and functionality. A malfunctioning or damaged garage door can leave your home vulnerable or inaccessible. Understanding how your insurance policy treats garage door issues is critical to making an informed decision before initiating a claim.

Knowing whether your situation qualifies for coverage is essential before you contact your insurance provider or file a claim. Let’s explore the factors determining if your policy covers your garage door and what steps you should take to ensure you don’t unnecessarily pay out-of-pocket.

What Determines If Homeowners’ Insurance Covers Garage Doors?

When protecting your home, homeowners’ insurance is an essential safety net—but what about specific parts of your property, like garage doors? Whether homeowners’ insurance covers garage doors doesn’t have a simple yes or no answer. It depends on several important factors, including the type of coverage in your policy, the cause of the damage, and whether the garage is attached or detached from the home.

Understanding Standard Coverage

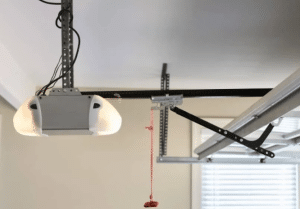

Most standard homeowners’ insurance policies include coverage for the primary structure (your home) and other structures on the property. This typically encompasses attached garages, detached garages, sheds, and similar outbuildings. Garage doors—part of those structures—are generally included in this coverage. However, insurance only applies under certain conditions, and the cause of the damage plays a significant role in determining eligibility for a claim.

Covered Events

In general, homeowners’ insurance will help pay for repairs or replacement of a garage door if a covered peril causes the damage. These typically include:

- Vandalism: If someone intentionally damages your garage door, such as by graffiti or forced entry, your policy will likely cover the repair.

- Theft: Coverage usually applies if someone breaks into your garage, damages the door, or steals property from within the garage.

- Fire: Garage doors damaged in a house fire or a fire that originates in the garage are typically covered under your policy.

- Certain Natural Disasters: Perils like windstorms, hail, or falling objects (such as tree branches) may be covered, depending on the terms of your policy and your geographical location.

- Vehicle Impact: If a car crashes into your garage door, especially if it’s someone outside your household, insurance usually steps in to cover the damage.

Exclusions and Limitations

While homeowners’ insurance offers broad protection, there are clear exclusions. Damage due to regular wear and tear, aging materials, rust, mold, or general lack of maintenance is not covered. Similarly, suppose a household member accidentally backs into the garage door. In that case, the damage may not be covered under your homeowners policy, though it might fall under your auto insurance. Additionally, intentional acts, such as purposefully damaging your property, are never covered.

Policy Variations Matter

It’s important to note that policy details vary by insurer and location. Some policies might require you to purchase additional coverage for detached structures, or they might limit how much coverage is available for damage to secondary buildings like garages. It’s always wise to review your policy and consult your insurance agent to clarify the terms and ensure your property is fully protected.

Covered vs. Non-Covered Incidents: Know the Difference

To better understand how homeowners’ insurance applies to garage doors, it’s helpful to break down specific scenarios into two categories: typically covered and not. This distinction can save you time, frustration, and unexpected out-of-pocket expenses.

Covered Scenarios

These incidents are generally included under most standard homeowners’ insurance policies, as they are considered sudden and accidental events:

- Storm Damage: If your garage door is damaged by a covered weather event, such as a windstorm, hailstorm, or even falling debris from a tree during a storm, your policy will likely pay for the necessary garage door repairs or replacement, depending on your coverage limits and deductible.

- Vandalism or Break-In: If someone breaks into your garage or intentionally damages the garage door (for example, graffiti or forced entry), homeowners insurance typically covers the repair costs. In the case of theft, items stolen from the garage may also be covered, though this can depend on your policy’s personal property limits.

- Fire: Damage from fire is one of the most universally covered perils in homeowners’ insurance. Whether the fire originates in the garage or elsewhere in the home, the destruction of the garage door (and any structural or personal property damage associated with it) will likely be covered.

- Vehicle Damage by a Third Party: If someone outside your household—such as a neighbor or stranger—accidentally drives into your garage door, you may be able to file a claim through your homeowner’s insurance. The at-fault driver’s auto insurance liability coverage will often be responsible. If the driver is unidentified (as in a hit-and-run), your policy may still provide coverage depending on the terms.

Not Covered Scenarios

These scenarios are typically excluded from standard homeowners policies because they involve preventable or non-accidental causes:

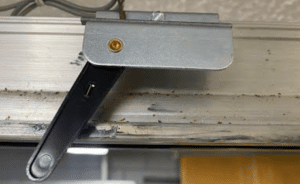

- Old Age and Wear and Tear: Garage doors naturally degrade over time due to exposure to the elements, daily use, and aging materials. Issues like rust, warping, faded paint, or broken springs caused by prolonged use are part of routine homeownership and are not covered by insurance.

- Lack of Maintenance: If you’ve ignored minor issues, such as a misaligned track, loose hardware, or deteriorating seals, which eventually lead to major damage, your insurer may deny the claim. Insurance is intended for sudden, unforeseen events, not damage resulting from neglect or deferred maintenance.

- Damage Caused by a Resident’s Vehicle: If you or a household member accidentally drives into the garage door, homeowners’ insurance typically won’t cover it. However, you may be able to file a claim under collision coverage through your auto insurance policy. It’s important to note that such claims may still result in a deductible and potential premium increases.

What to Do Before Filing a Claim for a Garage Door

If you’re considering filing a claim, preparation is key:

- Document the Damage: Take clear photos and videos from multiple angles.

- Review Your Policy: Make sure the incident falls under a covered peril.

- Get a Professional Inspection: Obtain a written estimate from a licensed garage door service provider to assess the damage.

- Contact Your Insurance Provider: File the claim only after confirming coverage and potential deductible costs.

Being proactive about these steps can streamline the process and improve your chances of receiving compensation.

How to Protect Your Garage Door From Future Claims

While homeowners’ insurance might cover certain garage door damage, prevention is still your best defense. Here are a few ways to reduce the risk:

- Regularly inspect for wear and tear

- Schedule annual maintenance

- Install motion-sensor lighting or a security system

- Make sure your driveway is marked to avoid accidents

Frequently Asked Questions

Does home insurance cover the garage?

Home insurance usually covers an attached garage as part of your house. Depending on your specific policy, a detached garage may also be covered—check your coverage details.

Are garage doors covered under warranty?

Yes, new garage doors often have a warranty covering parts like springs, panels, or the motor for a few years. The warranty may not apply if the door is misused or improperly maintained.

What home repairs does most insurance cover?

Most insurance covers damage from fire, storm, theft, or burst pipes. However, it usually doesn’t cover issues caused by wear and tear or lack of maintenance.

Does home insurance cover a broken door?

Yes, if the door was damaged by theft, storms, or fire, it’s typically covered. However, it likely won’t be included if the damage is due to aging or poor upkeep.

What is the most common damage to your home that insurance does not cover?

Damage from floods, earthquakes, and general wear and tear is usually not covered. Mold from leaks or an old, damaged roof may also be excluded.

Conclusion

Does homeowners’ insurance cover garage doors? In many cases, but only if the damage stems from a covered peril in your policy. It’s not a one-size-fits-all situation, which makes reading and understanding your homeowners’ insurance agreement crucial.

Don’t rush to file a claim if you’re unsure whether your garage door damage qualifies. Take the time to assess the situation, gather the appropriate documentation, and speak with your provider. This proactive approach helps prevent denied claims and costly surprises.

For residents of Keller, TX, and surrounding areas, ensuring your garage door is in top condition is easier with expert help. If you’re facing issues with your garage door, contact Keller Garage Doors. We’ll help you assess the damage and provide professional support before you make an insurance decision.

End Note

Keller Garage Doors proudly serves Keller, TX, and neighboring communities with dependable, top-quality garage door solutions. Whether you need garage door service or urgent emergency garage door repairs, we are committed to delivering exceptional service with every call.

Homeowners and business owners alike trust our team for both residential garage doors and commercial garage door installations. If you’re considering an upgrade, our experts offer seamless garage door replacement services customized to your home or facility.

We proudly serve all service areas, including Fort Worth, TX, and Colleyville, TX. Visit our blog for more expert insights, or reach out via our contact page to schedule a service today. As Keller’s premier garage door professionals, we look forward to earning your trust.

Keller TX Garage Door

1145 Bancroft Rd, Keller, TX 76248, United States

+18176972922